Throughout 2020, businesses saw increased awareness in technology investments and cybersecurity threats as corporations navigated work-from-home and lockdown mandates.

This need to invest in tech to increase – and protect – business value is not slowing down; it is the new norm as companies evolve to meet workforce and consumer needs.

With IT spend predicted to increase following deflated budgets in 2020, and predictions that a cyber attack will occur every 11 seconds in 2021, here are the top trends business leaders need to know when executing IT spend this year – and how these trends impact business growth, particularly for Private Equity firms.

IT Spend in 2021: An Overview

Trends in IT spend mirror what we saw in 2009 and 2010 when companies faced cash flow issues during the Great Recession. However, in 2021, the world is dealing with a recession caused by a global pandemic that has displaced employees and forced CIOs to rethink technology strategies and financial priorities. Corporations are dealing with cash and asset freezes while grappling with how to continue business operations with remote workforces.

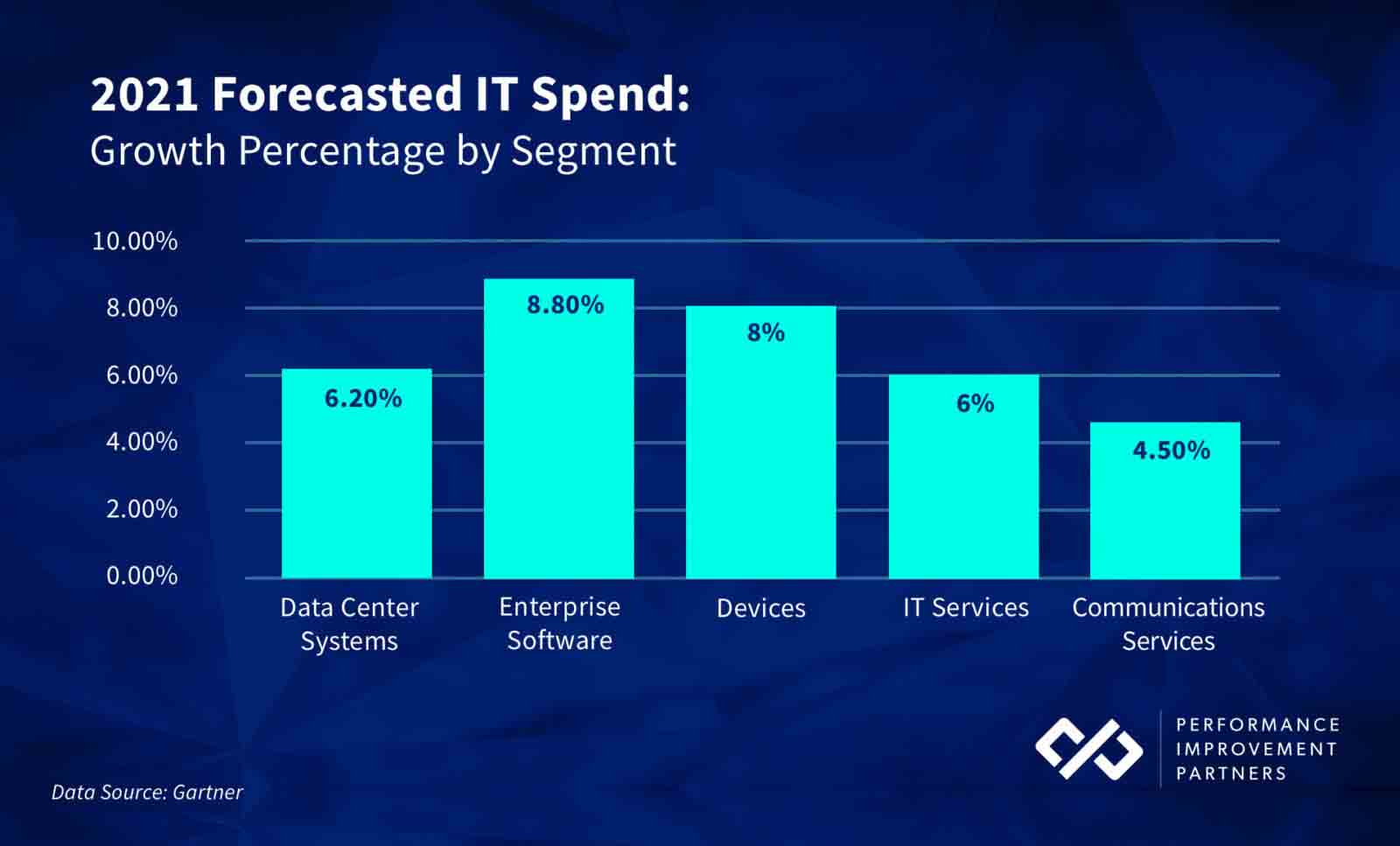

Gartner reports that IT spend will see an overall increase of 6.2% in 2021, with the highest increases predicted in enterprise software and devices.

With increased spend comes the opportunity to turn technology investments into a competitive advantage, as demonstrated by the following 2021 IT spend trends and statistics.

1. Acceleration of digital business transformation

89% of global technology company CEOs state their company’s digital transformation has accelerated by months – if not years – as a result of Covid-19.

The broad-reaching impact of digital transformation applies to every aspect of the business, both internal and customer facing, across B2B and B2C.

For example: Traditional business activities, such as the sales process, once requiring little more technology than a phone call or email, now demand a tech-enabled process. Bain’s 2021 Global Private Equity Report dispels the myth that in-person selling works better than virtual selling, demonstrating that a tech-enabled and analytics led processes leads to improved coverage, higher ROI, and customer loyalty.

Image source: Bain

Digital transformation within the workforce has also been accelerated by plans for the new hybrid workforce as employees return to work.

In fact, a recent Accenture study demonstrates that 83% of workers say a hybrid workforce would be optimal, and 63% of high-growth companies have enabled productivity-anywhere workforce models.

63% of high-growth companies have enabled productivity-anywhere models.

2. Updating cloud and infrastructure

Investing in tools and technologies that enable speed and agility continues to be crucial for businesses to survive and thrive in 2021. In fact, TechRepublic predicts that IT investments will not see the usual internal red tape they were accustomed to pre-pandemic; CIOs will sign off on new endeavors around cloud and digital tech overhauls as they are essential to the future survival of any business.

According to the 2020 IDG Cloud Computing Survey, 32% of total IT budgets will be allocated to cloud computing in 2021, and 67% of organizations are adding new roles and functions due to cloud investments.

Utilizing cloud computing and other digital technologies, which increase agility and performance, may also require spend to ensure devices and infrastructure aren’t out of date for the speed of technologies in 2021.

As explained by Fred Purdue, Infrastructure Practice Manager for Performance Improvement Partners, “IT hardware and software assets must be regularly updated, otherwise companies risk accumulating technical debt. Companies should have proactive lifecycle management policies in place that actively replace assets on a planned basis. Companies who don’t invest in these updates will find themselves accumulating technical debt through outdated platforms, services, and devices. This technical debt only grows over time, and carries its own form of interest in lost productivity, increased outages and failures, and increased security risks.”

Not only does that debt eventually need to be paid, outdated systems simply can’t support the sophisticated software programs that drive business growth.

3. Enabling better decisions – and operations – through data analytics

Our digitally transformed world creates data at an astronomical rate: It is predicted that by 2025, the data universe will consist of 175 trillion gigabytes.

With those trillions of gigabytes considered the oil of the fourth industrial revolution, investors looking to cash-in on the opportunity must utilize data analytics, converting raw data into the fuel that generates optimal value creation.

As organizations optimize their workflows, they will look to business intelligence teams to implement new measures in AI (artificial intelligence) and machine learning to provide solutions for scalability of business data to measure customer satisfaction and even streamline the accounting process.

The financial benefits of data analytics are demonstrated in McKinsey’s November 2020 State of AI Survey. Not only are respondents seeing increased revenue gains from AI compared to 2019, 22% of respondents report that at least 5% of EBIT is attributed to AI.

“What we’ve said in the past about ‘following the money’ to find where AI adds value in organizations still holds true. At the industry level, companies continue to use AI in areas that are most fundamental to where value is generated in each sector.”

– Michael Chui, Partner, McKinsey Global Institute, San Francisco

4. Revitalization of the customer experience with enterprise software

Corporations investing in enterprise applications will not only see higher success rates in engagement around teams but will be better equipped to support the full customer journey through manufacturing automation, CRM support, and communication automation.

The opportunity for growth through enterprise applications aligns with Gartner’s findings, in which enterprise software is predicted to have the highest percentage (8.8%) of 2021 forecasted IT spend growth.

5. Cybersecurity as a company strategy

With scaled remote workforces and rapid digital transformation comes increased cyber risks that jeopardize company data – and the bottom line. Executives are recognizing the increased importance of cyber protection: According to the PwC 2021 Global Digital Trust Survey, 55% of technology and security executives plan to increase their cybersecurity budgets this year.

IT spend trend in the news:

While cybersecurity statistics proving attacks are on the rise, Bloomberg labeled the recent attack on Microsoft a “global cybersecurity crisis” that has claimed 60,000 victims and counting. The mass attack compromised exchange servers around the world, hitting every server they could, regardless of purpose, size, or industry.

With hackers using automation to increase the sophistication of attacks, fears are high for what the new era of cyber crime may hold, making protection more imperative than ever. Learn more about the risks – and ways to protect yourself – in the 2021 Private Equity Guide to Cybersecurity.

What Trends in IT Spend Mean for Private Equity

We have seen the predicted numbers in IT spend change in just three months’ time. What started as a 4% predicted increase in IT spend overall in 2021 quickly moved to 6.2% increase, as analysts continue to navigate the ever-changing needs of enterprises due to COVID-19.

Many PE managers remain bullish about 2021 deals, especially related to those companies that fared well during 2020 — most due to their digital nature or quick pivots and investments in technology.

When looking for areas to generate portfolio value at speed, IT spend is more imperative than ever.

Companies that move swiftly and invest in these technology-driven business transformations will gain a competitive advantage over those that take a wait-and-see approach. At the rate of which enterprises are moving into cloud-based technologies, digital technologies, and enterprise software, investors can’t afford to watch from the sidelines.

To maximize the results of your IT spend in 2021, Private Equity firms – and their portfolio companies – need to invest in technology now to drive business growth.

Adapt to disruption

Identify gaps and change your thinking of IT supporting the business to IT being the business. As ZDNet states, this year the top contenders will be those that can provide anywhere business operations, automation, privacy-enhancing computing, and cloud distribution.

And, according to Deloitte, 87% of senior executives know their industry will be disrupted by digital technologies, yet only 44% believe their business is doing enough to prepare – proving those who plan for disruption now will reap the long-term rewards.

Strengthen your systems with digital tools and data

Companies that took a hit in 2020 had a hard time keeping up with the sudden shift in demands and ended up with a narrow focus on only the things they could accomplish then and now— there was no time to worry about the future.

A year into the pandemic, and with a handle on remote working needs, now is your opportunity to build on short-term wins and apply them to the long-term.

As stated by Christopher Penn, a three-time IBM Champion in IBM Analytics, and Co-Founder and Chief Data Scientist of Trust Insights, “Digital tools, online data sources, and artificial intelligence will be how organizations transform data into value. Data is just an ingredient. Just as a pantry of ingredients doesn’t magically become a meal, data requires the tools to extract insights and derive meaningful actions from it. Those organizations that can extract value from their data will have a nearly insurmountable edge over competitors who don’t.”

“Digital tools, online data sources, and artificial intelligence will be how organizations transform data into value…those organizations that can extract value from their data will have a nearly insurmountable edge over competitors who don’t.”

– Christopher S. Penn, Co-Founder and Chief Data Scientist, Trust Insights

A digital world lacks the paper print-outs so common to Private Equity firms. Implementing process documentation tools, such as project management, e-signature, and workflow process software increase efficiency while maintaining a record of documents and procedures that is not only digital, but also secure.

Use data to shift your thinking to growth planning instead of reactive responses. Automation and cloud technologies are just two ways IT spend and digital tools support a growth mindset.

Don’t discount the importance of cybersecurity

Ensure cybersecurity is a C-Suite priority that aligns with digital transformation efforts. Participants in PwC’s Global Digital Trust Survey study have established that the two go hand-in-hand: 40% of executives accelerated digitization for growth, and 50% report that cyber and privacy will be baked into every business decision and plan.

“Financially unhealthy portfolio companies often end up carrying a significant amount of technical debt. Some PE Firms and portfolio companies feel they cannot ‘afford’ to fix it, but the bill must be paid eventually. The interest on technical debt comes due when executives find themselves face-to-face with a major security incident – such as the recent Microsoft breach – and are unable to protect themselves from attack.”

-Fred Purdue, Infrastructure Practice Manager, Performance Improvement Partners

Thankfully, there are cost-effective solutions to maximize protection: 72% of the executives surveyed believe they can strengthen their cybersecurity posture while containing costs.

Understanding a company’s technical debt – and if systems are outdated – is also imperative to ensure cyber protection, as demonstrated by the recent Microsoft breach

Discover cost-effective ways to protect your portfolio in PIP’s free cybersecurity workshop, recognized by ACG Middle Market Growth.

Aligning 2021 IT spend with the investment lifecycle

The balancing act is real—you need to save money while investing in and making significant changes to IT structures. You also must be mindful that you do not waste IT budget (upwards of 30% of typical IT budgets are wasted each year). Thankfully, a pragmatic approach to technology investments provides the opportunity for cost-effective improvements.

As IT spend relates to M&A strategy, do your due diligence. IT due diligence mitigates risk up front, provides better valuation, and identifies issues – as well as opportunities — that could have a detrimental impact on value creation. Evaluate overall IT strategies, processes, and structures. Analyze integrations. Identify IT costs, assess cyber vulnerabilities, and the overall health of technology and operations supported by IT. Then, take the next step and look for opportunities to create value through technology.

In this fast-paced IT world, quick decisions and the ability to pivot are paramount to capitalizing on portfolio growth.

Find out how to maximize your IT spend in 2021 and build your technology transformation strategy.