Data-driven decisions have always been integral in creating business value. Now, as companies ready themselves for continuous pivots while navigating the new normal, leveraging existing data assets — and turning them into actionable insights — is imperative in maximizing ROI.

As cited by a 2020 Deloitte report, “Navigating the New Normal with Data Driven Decision Making,” the first guiding principle in maneuvering 2021 and beyond depends on a scientific, fact-based approach: “Leaders should drop all notions of instinct-based decision-making and rewire the mindset and cultural DNA of their organizations to be data—or science—driven.”

Moving from gut-decisions to a scientific approach is especially imperative for Private Equity professionals when building and evolving their investment strategy. Data-driven decisions provide a managed, measured approach which uncovers opportunities otherwise lost in existing internal data – a proven company asset that all-too-often goes to waste.

To understand how data analytics drives business value, this article includes:

- Research proving the competitive advantage from data analytics that is often overlooked

- How data analytics impact the investment lifecycle

- The types of data firms need to generate value and maximum ROI

Data analytics give a competitive advantage to drive business value

Proving the importance of a data-driven mindset, a PwC survey of over 1,000 senior executives demonstrated that highly data-driven organizations are three times as likely to report significant improvements in decision-making.

Additional statistics establish how data provides a wealth of opportunity for Private Equity firms to increase revenue, build their customer base, and lower operational expenses. Consider the following:

- Data-driven organizations are 23 times more likely to acquire customers than their peers.

- A University of Texas study found that increasing data usability by just 10% could increase revenue for the average Fortune 1000 company by over $2 billion

- 92% of businesses cite business transformation with increased agility — and the ability to operate more competitively — as the driving factor behind investments in data and AI

Yet, while data provides opportunity for growth, it is an asset that is all-too-often overlooked:

- Unstructured data is a problem for 95% of businesses

- 63% of employees report they cannot gather insights in their required timeframe

- Only 31% of companies identify themselves as being data-driven; down from 37.1% in 2017

With so few companies able to utilize the data lying at their fingertips, PE professionals who leverage portfolio company data will find themselves with a fierce advantage over competitors — an advantage that leads to outsizing anticipated investment outcomes.

How data analytics impact the investment lifecycle

Across every stage of the investment lifecycle, data analytics provide the insights companies need to deliver ROI and maximize returns.

Pre-acquisition, investors must forecast, based on visibility surrounding existing revenue and pipeline data, how much revenue runway they will have post-acquisition. With too short of a runway, firms risk becoming cash flow negative shortly after the acquisition. Assessing the likelihood of how much revenue each client will generate is another element of pre-acquisition data analysis.

In addition to revenue, examining the cost structure is a critical factor in pre-acquisition analytics. For both revenue and costs, once firms move into the entry period, it is necessary to take data analysis to the next level.

Given pre-acquisition data is limited based on who has both 1) access to the data, and 2) knowledge of the pending sale, data analysis is a top priority when entering the investment and growth period. Compiling all portfolio data for a clear, holistic view is how firms discover the greatest opportunities for ROI, ensuring portfolio companies realize their maximum potential.

For example, analyzing a portfolio company’s existing data assets may reveal:

- If sales are low on the most profitable products or services, resulting in the need for marketing and sales to re-prioritize these offerings

- Common demographics or themes to build customer segments and ideal customer profiles (ICPs) who generate the most revenue

- If the highest-cost areas of the business process are tied to any particular products, and, upon further examination, how much revenue these products deliver, and what waste can be eliminated

As shared by Matt Sabo, Director of Data Analytics at Performance Improvement Partners, “Data is needed on a continual basis to formulate the best strategy for growth, then execute on that plan effectively. It is when data has been effectively applied during the investment period that maximum returns can be realized.”

What data analytics are needed to drive value and maximize ROI

When shifting company culture towards data-driven decision making, Private Equity firms and portfolio company leadership should begin by focusing on how utilizing data drives value and maximizes ROI.

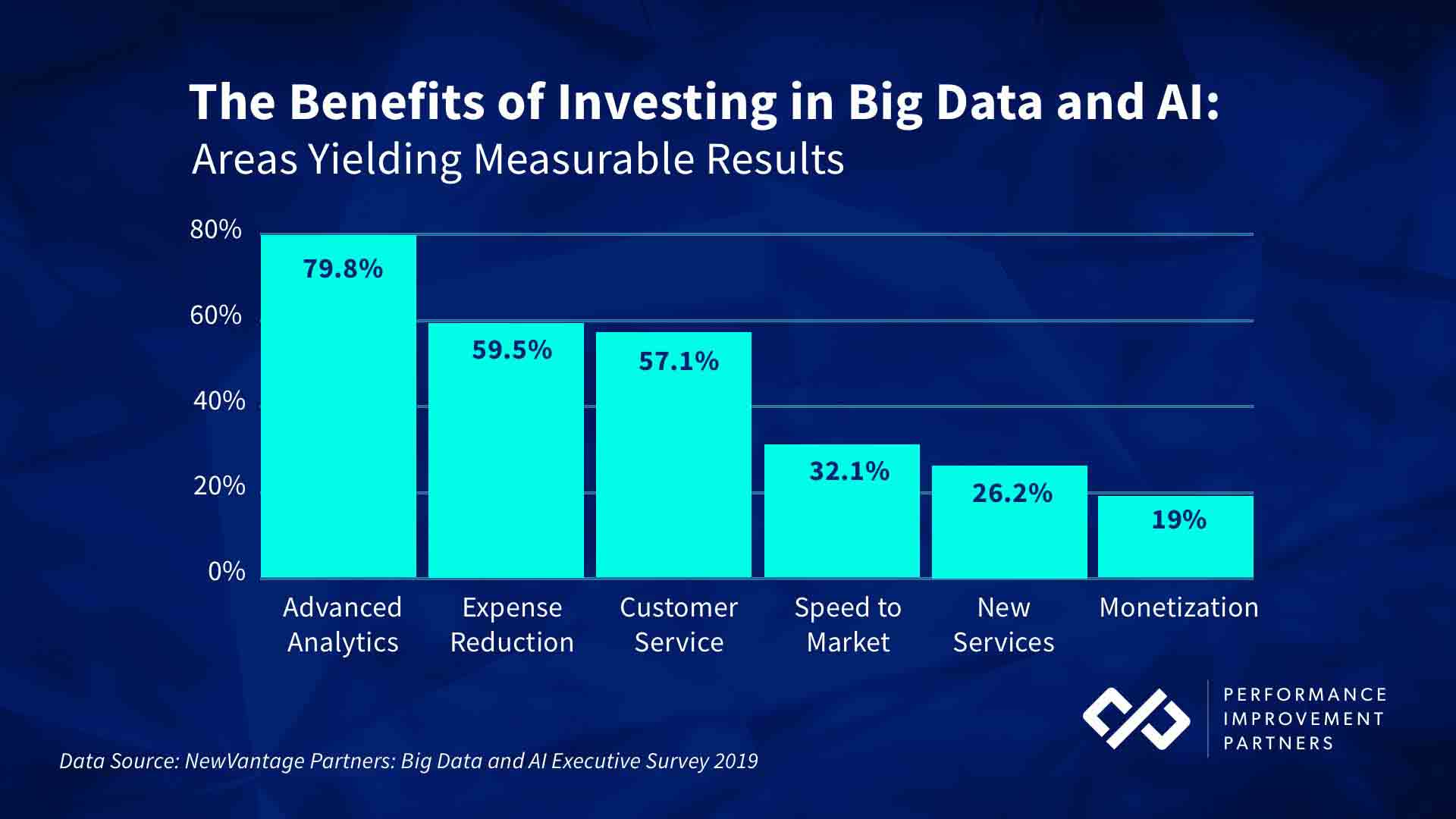

Studies have demonstrated the positive outcomes realized from investing in data analytics, including increased revenue, decreased costs, and more. Executives in a 2019 NewVantage Partners Study identified six areas their companies saw measurable results after investing in Big Data and AI. Notably, for Private Equity professionals, 60% of respondents reported reduced expenses.

To drive outcomes that generate outsized returns, PE firms should be able to answer the following questions for each of their portfolio companies:

- Which products or services are most profitable?

- What are the best-selling products or services, and to what customer base?

- What are the highest-cost areas of the business process, and what variables – time, salary, energy, or raw materials – drive those costs?

When looking to organize and analyze existing data, companies are drawing information from an average of 400 different data sources, adding to the challenge of efficiently utilizing data. To overcome this challenge, firms can start by recognizing exactly what data points generate the most value.

Both PE Firms and portfolio company leadership must have regular access to the following continually updated data:

- A clearly defined index of products and services: Within this list of company offerings, all like products and information systems should be classified using the same code or description. A clear understanding of the pricing or rate structure is also needed. Companies must be able to clearly delineate between all products and services in this master list, ensuring they can drill down to granular levels of detail when needed. If products and services are grouped together, it can be difficult to delineate a product’s individual value.

- A master repository of all customers: In addition to one master customer list, it is imperative that any customers with details recorded in multiple platforms can be identified using the same code or description across all systems. This also applies to how business names are recorded within systems — an acronym used in one platform, but not another, can derail data integrity, limiting efficient and accurate analysis.

Additional master lists as needed: Depending on the business model, this may include lists of facilities, employees, cost centers, or how departments are organized. - Company-wide sales: Firms should maintain access to regularly updated lists of all sales which can be broken down as needed – for example, sales may be segmented by region or product category.

- All business costs: For any products or services sold, it is necessary to understand not just what revenue is generated by a product segment, but the costs that go into delivering that product. Standard accounting systems can fall short in measuring the true profit of an offering, limiting the ability to evaluate true earnings by offering.

Want to know more about how PE firms are using data to identify risks and opportunities?

Get webinar access now >

Using data to drive business transformation and growth

In today’s reality, all companies are digital. As a result, every company is now a data company.

As stated by Grant Bowers, Franklin Templeton Research Analyst, “One of the biggest overarching themes we see is this theme of digital transformation…this data-centric world is moving out of tech and moving into all of these other industries [including] transportation, healthcare, [and] consumer.”

When it comes to maximizing data analytics within a portfolio company — or our own firm — the companies who take an offensive approach are set to recognize the highest gains looking to 2021 and beyond.