M&A & Technology Advisors.

Built for Private Equity. Driven by Outcomes.

M&A & Technology Advisors. Built for Private Equity. Driven by Outcomes.

Aligning operational execution with the investment thesis to unlock value at every stage—from diligence through exit.

PIP is the leading technology advisory firm exclusively serving private equity firms in the middle- and lower-middle market.

We don’t just solve IT problems — we unlock hidden value.

Through our proprietary ValueBridge methodology, we focus on driving value and performance improvement throughout the entire investment lifecycle.

Trusted by top companies across various industries

Introducing ValueBridge:

We Drive Value Where It Matters Most

ValueBridge is our framework for value creation that aligns our work to the outcomes that our clients measure. We align seasoned M&A resources, innovative thinking, and our outcome-driven methodology to the investment thesis to drive maximum value across every step of the investment lifecycle.

Pre-Acquisition:

We move beyond surface-level diligence to uncover risks and validate growth potential — ensuring that you’re not just making a deal, but making the right deal. The result is greater confidence in your investment thesis and a stronger foundation for value creation from Day One.

Transaction Support:

When the deal is in motion, every decision impacts how quickly value can be realized. We position portfolio companies to hit the ground running, minimizing risks and aligning operations with your goals. With ValueBridge, your 100-Day Plan starts delivering before Day 1.

Close + 100 Days:

This early post-close window is your chance to build real momentum. We help translate strategy into measurable wins — cutting costs, optimizing systems, and setting the trajectory for EBITDA growth that compounds through the hold period.

Hold Cycle Improvement:

The focus shifts from stabilization to acceleration. We unlock operational efficiencies, enable digital growth, and help portfolio companies leverage technology for competitive advantage. Every move we make ties back to profitability and expanding enterprise value ahead of exit.

Exit & Sell-Side Preparation:

When it’s time to sell, you don’t just want a buyer — you want a premium. We help eliminate surprises, close gaps before diligence, and showcase operational strength. The result: cleaner deals, stronger valuations, and better outcomes for your investors.

Pre-Acquisition:

We move beyond surface-level diligence to uncover risks and validate growth potential — ensuring that you’re not just making a deal, but making the right deal. The result is greater confidence in your investment thesis and a stronger foundation for value creation from Day One.

Transaction Support:

When the deal is in motion, every decision impacts how quickly value can be realized. We position portfolio companies to hit the ground running, minimizing risks and aligning operations with your goals. With ValueBridge, your 100-Day Plan starts delivering before Day 1.

Close + 100 Days:

This early post-close window is your chance to build real momentum. We help translate strategy into measurable wins — cutting costs, optimizing systems, and setting the trajectory for EBITDA growth that compounds through the hold period.

Hold Cycle Improvement:

The focus shifts from stabilization to acceleration. We unlock operational efficiencies, enable digital growth, and help portfolio companies leverage technology for competitive advantage. Every move we make ties back to profitability and expanding enterprise value ahead of exit.

Exit & Sell-Side Preparation:

When it’s time to sell, you don’t just want a buyer — you want a premium. We help eliminate surprises, close gaps before diligence, and showcase operational strength. The result: cleaner deals, stronger valuations, and better outcomes for your investors.

Pre-Acquisition:

We move beyond surface-level diligence to uncover risks and validate growth potential — ensuring that you’re not just making a deal, but making the right deal. The result is greater confidence in your investment thesis and a stronger foundation for value creation from Day One.

Transaction Support:

When the deal is in motion, every decision impacts how quickly value can be realized. We position portfolio companies to hit the ground running, minimizing risks and aligning operations with your goals. With ValueBridge, your 100-Day Plan starts delivering before Day 1.

Close + 100 Days:

This early post-close window is your chance to build real momentum. We help translate strategy into measurable wins — cutting costs, optimizing systems, and setting the trajectory for EBITDA growth that compounds through the hold period.

Hold Cycle Improvement:

The focus shifts from stabilization to acceleration. We unlock operational efficiencies, enable digital growth, and help portfolio companies leverage technology for competitive advantage. Every move we make ties back to profitability and expanding enterprise value ahead of exit.

Exit & Sell-Side Preparation:

When it’s time to sell, you don’t just want a buyer — you want a premium. We help eliminate surprises, close gaps before diligence, and showcase operational strength. The result: cleaner deals, stronger valuations, and better outcomes for your investors.

Why PE Firms Trust PIP

ValueBridge is your strategic partner, adapting to each phase of the investment lifecycle. We ensure that our initiatives are aligned with your investment goals for maximum impact.

“Performance Improvement Partners consistently provides us with IT experts and practitioners who contribute to our team in meaningful ways. Management and consultants listen to our needs, identify the root cause of challenges, and deliver practical solutions that have a significant impact on the business.”

“Since 2003, PIP has provided us with sophisticated solutions that support the unique technology needs of our Private Equity Firm. At the same time, they make the complex simple – particularly for our portfolio companies — breaking implementation down into manageable parts. PIP is our go-to technology partner thanks to their ability to listen, understand, and consistently create solutions that act in the best interest of both our firm and our portfolio companies.”

“My 10 years of partnership with Performance Improvement Partners has led to significant value creation across our portfolio. Their approach is both sophisticated and pragmatic, resulting in over a dozen successful enterprise system implementations. Our portfolio companies have nothing but good things to say about PIP, which we too have witnessed in their strong operational and technical expertise.”

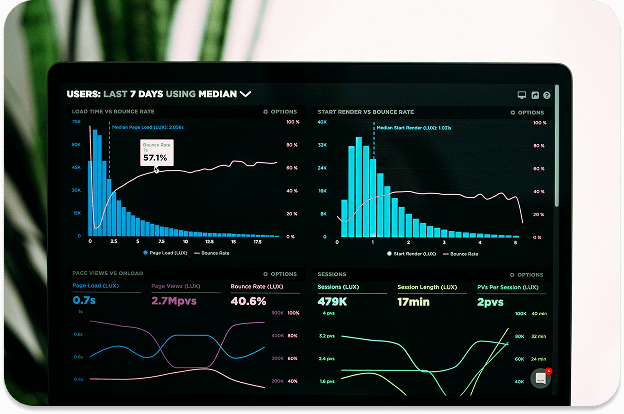

Insights on Digital Transformation

Explore our latest articles and insights.

Build-and-buy is one of the most powerful strategies in private equity. Done well, serial add-on acquisitions can achieve returns that organic growth alone can’t match.

IT integration protects your EBITDA. Business integration scales it. Most sponsors conflate the two, and pay for it at exit. Here’s what actually happens post-close on buy-and-build platforms:

Most PE firms enter a deal with a clear value creation thesis. The problem is what happens after close. For lower-middle-market firms, those investing in

When patient data and uptime are mission-critical, every minute of downtime costs more than money. Cloud-based disaster recovery (DR) is reshaping healthcare IT by enhancing

Private Equity (PE) firms are facing unprecedented pressure: record dry powder, rising competition for quality assets, and sustained high valuations. In this environment, corporate carve-outs—acquiring

Your portfolio company is pursuing or has just achieved SOC 2 Type II compliance certification. However, achieving SOC2 certification does not end your cybersecurity journey.

Let’s Maximize the Full Potential of Your Investment

At Performance Improvement Partners, we specialize in delivering innovative technology solutions tailored for Private Equity firms and their portfolio companies. Our mission is to drive digital transformation and enhance operational efficiency to unlock maximum value.