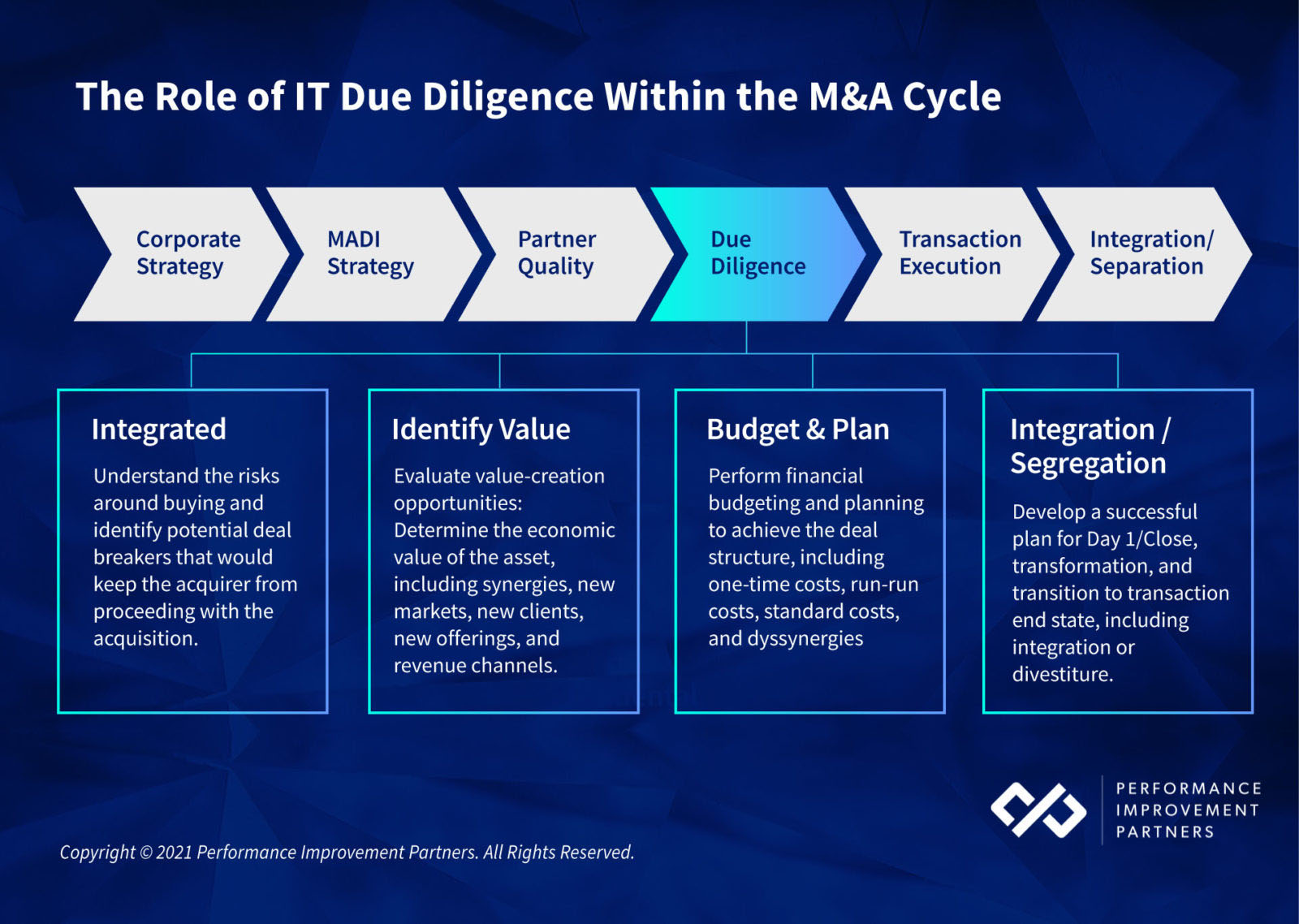

Due diligence — technology due diligence specifically — is an important part of the M&A process.

It has become essential as investors follow the Digital Transformation path. The output provides the risk and potential value of technology in relation to your opportunity, industry, and company.

Technical due diligence is a discovery process and set of best practices and recommendations that provide guidance on key risk mitigation needs along with opportunities for value creation. It identifies key integration or separation areas that could impact the value of the deal and evaluates all the disparate tech components within a company and everything required to use that tech to uncover hidden threats.

The goal is to outline anything that could make for less profitable transactions. By investing in technical due diligence, companies can make faster, informed and value-based decisions that directly impact value creation.

Technology due diligence is part of the information-gathering stages of the M&A cycle. By ensuring your pre-acquisition assessment includes all areas covered in this IT due diligence checklist, you:

- Get a broad picture of risks in all areas

- Understand the real value of the target company

- Make informed financial planning

- Develop a value-driven plan that aligns with your value creation thesis

The Importance of an IT Due Diligence Checklist for PE Firms

Technology continues to become more integrated and complex, yet it remains a vital component to business transformation and growth — one that spans the investment lifecycle for any Private Equity Firm.

This business transformation is reshaping technical due diligence for mergers and acquisitions and divestitures. As the McKinsey Global Survey on digital strategy reports, a slim 11% of companies believe their current business models will be economically viable through 2023 while the majority (64%) state they need to build new digital businesses to remain viable.

There remains an ongoing — and imminent — need for the acquirer to be vigilant in assessing all areas of risk, tech included.

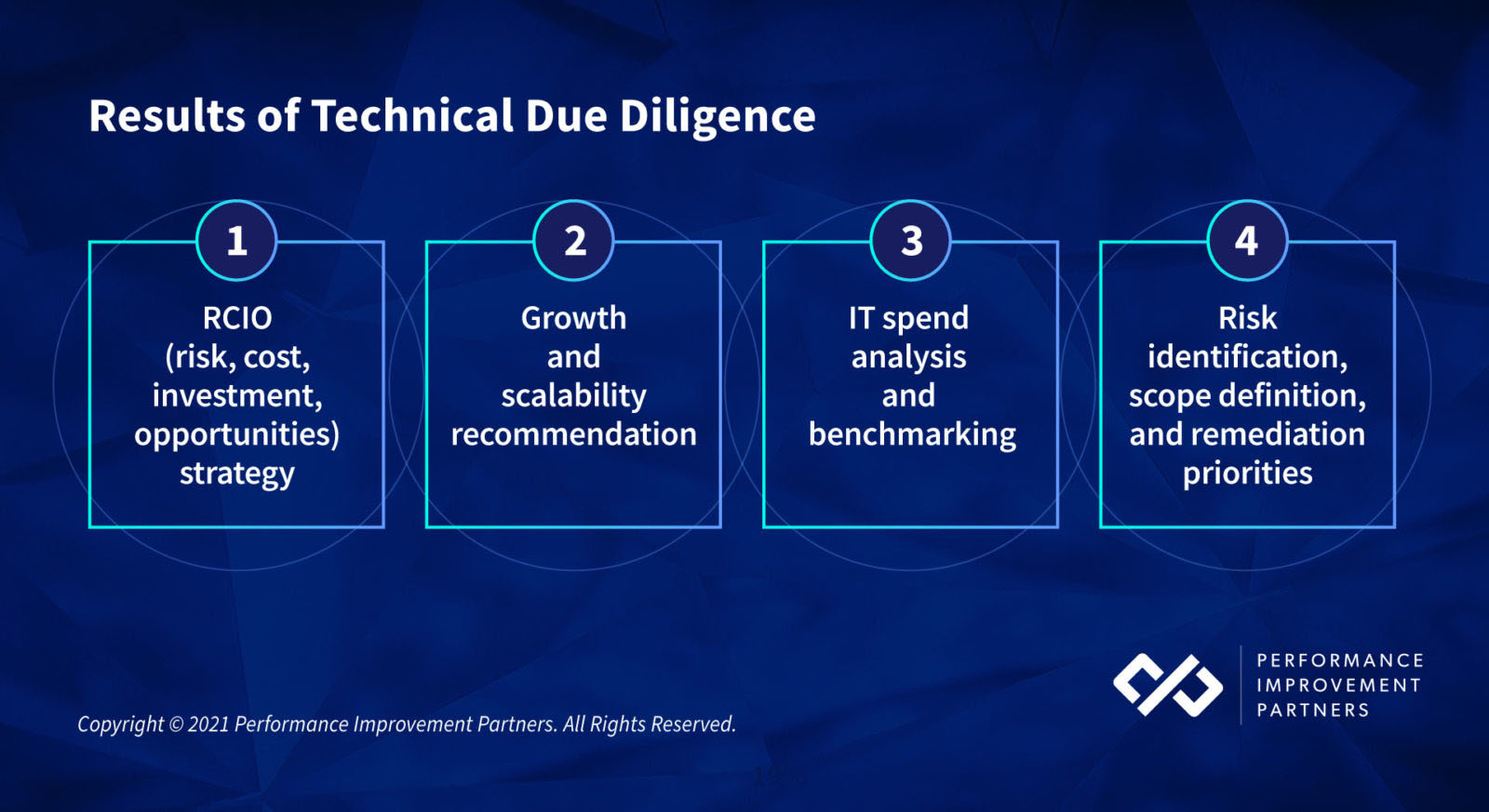

The key outcome of technical due diligence is the identification of business and technology risk. The deliverable and resulting process outlines costs, investments, and opportunities involved in the transaction. It also provides information on growth and scalability for the private equity firm.

A comprehensive it due diligence checklist is the first step in creating a roadmap to increase investment value and prioritize opportunities in any upcoming merger or aquisition.

From your technology due diligence checklist, you can develop an action plan around your technical assets and health with a 360-degree viewpoint.

While commonly used by dealmakers in the M&A process, the items in this checklist are imperative for both on the buy-side and sell-side.

The buy-side of a mergers & acquisitions due diligence checklist

Buyers want peace of mind before committing to an acquisition. The world is digital and security across all aspects of tech is critical. Before committing to a deal, the buyer needs to identify risks and potential costs that could impact the business—now or in the future.

As such, the buyer needs a comprehensive understanding of the target company’s tech stack, its IT capabilities, infrastructure, devices, software, potential security risks, proprietary or unique tools, or technical debt that may be acquired with the transaction. All of these are part of the IT due diligence process.

Buyers also need to understand the level of complexity associated with the carve-out/integration onto current platforms. Does the separation have complex entanglements with the parent? Are systems compatible or will the integration require a high level of manual effort?

The sell-side of a technical due diligence checklist

Due diligence is not merely the responsibility of the buyer. In fact, if the seller is proactive in providing a technical due diligence report to the buyer, the process becomes more streamlined, and many times can end in a higher valuation.

Identify issues and work toward solutions prior to sale; it will alleviate stress and unforeseen roadblocks that could appear when working with a potential buyer during the transaction process.

Your Technical Due Diligence Checklist: The Can’t-Miss Elements Any Investor Must Assess

Consider the following eight areas a broad, high-level view of the components which must be covered as part of a M&A due diligence, recognizing that the specifics will vary based on the nature of your deal and the target company.

Download the complete IT due diligence checklist for the comprehensive list of elements to be evaluated when addressing a target company’s technology.

Identify risks. Unlock value creation opportunities.

IT Strategy

Start with the IT strategy. Understanding the current technology strategy — and how far it can scale — is imperative to understanding the depth of the investment opportunity.

A solid IT strategy ensures that there is a good, long-term vision that lays out a roadmap aligning IT initiatives with key business goals, strategies, and initiatives. This roadmap should be supported by program schedules and budgets.

IT Support Staff and Operations

Personnel can be a liability just as much as lack of common and well-defined procedure. Your technical resources must not only have the enterprise and familiarity with specific technology platforms, but need formal documentation around vendor management, support, upgrades, and platform interdependencies. Who are the key employees on the IT team who will guide transformation efforts through the merger and acquisition process?

Staff maturity readiness, and culture, in addition to operational sophistication and key leadership, should be assessed as part of your IT staff and operations review.

Key findings when assessing business operations and IT staff include supplier and vendor management, IT leadership, the extended team, service delivery, project portfolio management, IT spend, and technical debt.

Business Applications

This area of due diligence includes a wide variety of core business applications, covering areas that include finance, HR, and sales. The goal is to identify scalability, reliability, and documentation gaps, along with impediments that influence speed-to-market.

The components assessed in this area include delivery models, maintenance, architecture, in addition to a determination of whether these applications are automated or manual.

Risks that come to light in this area may include business and IT alignments, disaster recovery planning and gaps, or ineffective policies and procedures.

Network and Cybersecurity

A company’s reputation can hinge on many things, not in the least is its ability to defend against data breaches. A review of all network and cybersecurity processes and procedures is key. In this area, some things to consider are data security, logical security, physical security, regulatory compliance, detection, and remediation. An assessment of personal data and HIPAA (as appropriate), also falls into this review area.

Protect your portfolio now

Learn how to secure your investments with a complimentary cybersecurity workshop; exclusive to Private Equity firms and their portfolio companies. Secure your spot now in this 1:1 workshop recognized by ACG Middle Market Growth.

Hardware

A review of physical equipment—such as printers, computers, phones, vehicle fleets, servers, storage, and production equipment—is an important part of the due diligence process.

It is a business imperative to understand the lifecycle of such items including replacement timing, support terms, end of life considerations, and related costs. This is part of the due diligence process that reviews technical debt which can inform process and procedure moving forward. Remediation and proactive management of hardware lifecycles save time, resources, and money in the long run.

Software

A software review includes any proprietary software, intellectual property, and software development and documentation processes, such as open-source components and enterprise applications. It explores questions such as: is the software in question still supported? Are these software programs critical to business operations? What is the cost(s) associated with them and are there contracts in place?

For instance, when assessing packaged software, review software versions, security patches, customizations, and processes into which the software has been integrated. For proprietary software, review the development stack, documentation, code efficiencies (and vulnerabilities), and the platforms that use such software.

Part of the technology due diligence process is identifying quick wins to make fast improvements for what to do next. These outcomes provide deep-dive reviews and validation of assets to develop value creation roadmaps. When acquiring EdTech platform, HGGC used IT due diligence to do just that, identifying areas for growth to maximize value creation.

Find out how HGGC defined scalability to support future growth

Customer Support Systems

How do employees work with IT to engage with customers? The customer support systems built into the IT infrastructure can give insight into staffing levels, customer satisfaction, opportunities for improvements or automation, and general customer service workflows.

The customer experience is digital—from using analytics to assess satisfaction to incorporating real-time, in-store recommendations—investing in customers’ needs to be a top priority. Connecting with them through the right technology and digital channels they prefer is a key component to digital transformation.

Infrastructure

When reviewing IT infrastructure, look for inefficiencies in policies and procedures. This can include evaluation of operating stability, End of Life of assets, functional deterioration, even telecommunications infrastructure such as internet systems, telecom systems, call center data, and call analytics.

Hardware includes not only infrastructure but also personal devices. A review of the physical equipment— such as printers, computers, phones, vehicle fleets, and production equipment —is an important part of the due diligence process.

It is imperative to understand the lifecycle of such items including replacement timing, maintenance, patching, version control, support and costs. This helps to plan and interject with modifications that may save time, resources, and money in the long run. If you acquire a company with outdated hardware, you risk being unable to activate value-creation plans driven by technology and digital transformation.

For example, as the workforce shifts to new remote and hybrid models, consider the cybersecurity risks—do you know all of the information these employees have access to? Do they operate out of secure home networks, public workstations, or other areas where channels need to be encrypted?

Don’t let your next investment deal be deterred by red flags.

Plan a detailed, value-driven approach to due diligence with this comprehensive checklist.

Don’t get caught flat-footed: Get your free Technical Due Diligence checklist now:

Due Diligence in the Real World: Case Studies Illustrating Growth Potential

Part of the technology due diligence process is identifying quick wins to make fast improvements for what to do next. PIP’s value is in our ability to perform quick-turn due diligence with a value-driven approach. The outcomes provide deep-dive reviews and validation of assets to develop value creation roadmaps as seen in the following case studies:

- HGGC defines scalability to support future growth.

- Vetting value creation opportunities for Healthtech acquisition.

A Technical Diligence is Only as Good as the People Providing it

Working with the right technology partner during due diligence will help you quickly identify key technology risks and value creation opportunities. This process can provide a seamless transition to executing on post-acquisition project work, in turn saving your team critical time during the first 100 days. Investing in due diligence is a proactive approach to strategic insight and value. Get your value creation process started with a PIP technical due diligence

Get the IT due diligence trusted by 300+ Private Equity Firms