More than ever, technology is vital to business growth.

Thanks to the lockdown, digital transformation has accelerated at a pace once thought unimaginable: A McKinsey study illustrates how Covid-19 has “pushed companies over the technology tipping point,” speeding up the use of digital technologies by nearly a decade.

This accelerated transformation is reflected by the fact that 2021 IT spend is predicted to grow 6.2%, despite just 36% of CEOs reporting high confidence in revenue growth over the next 12 months. Of those same CEOs, almost half – 49%, plan to increase their spend on digital transformation by 10% or more.

Clearly, executives have recognized technology’s foundational importance in driving business growth. As technology becomes an increasingly vital component to growth and business transformation, one question should be on the minds of Private Equity professionals: How does technology factor into your investment thesis?

The opportunity to drive value creation through technology implementation spans the investment lifecycle – and it starts with a renewed approach to IT due diligence, where technology and financial assessments stand on equal ground.

How Digital Business Transformation is Reshaping IT Due Diligence for Mergers and Acquisitions

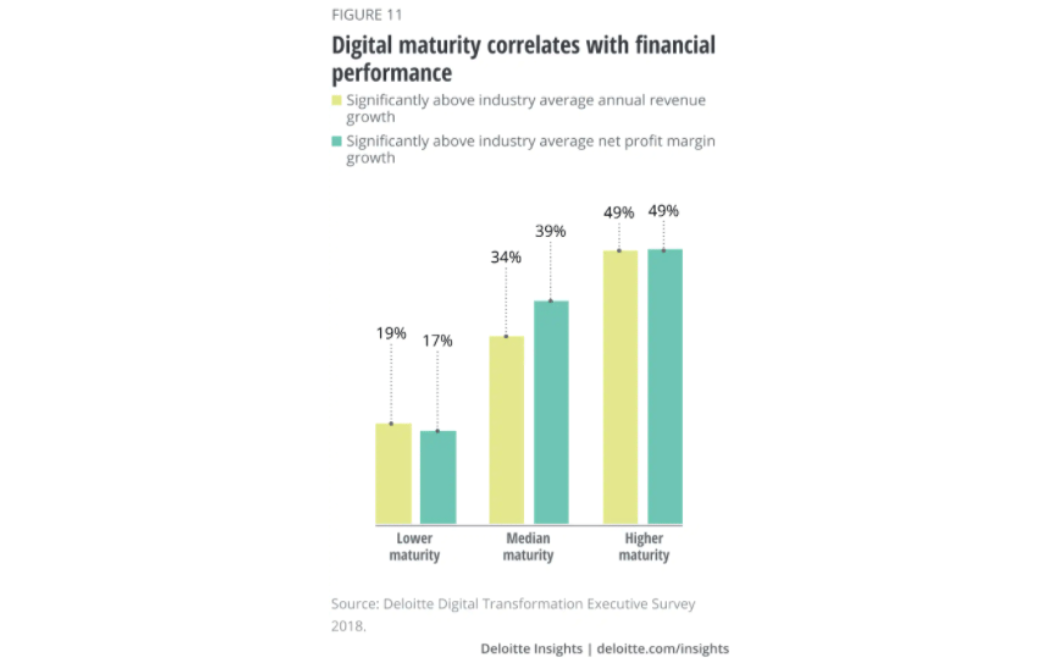

According to Deloitte, digital maturity directly correlates with financial performance, demonstrating how technology – and digital maturity – not only helps drive future top- and bottom-line growth, but also signifies that financials and technology are inescapably intertwined.

With technology’s impact on financial performance and its continuous evolution, deal teams must now take a more progressive approach to IT due diligence, one that considers minimizing risks and maximizing growth to deliver value across the ownership lifecycle.

The path toward technology-driven value creation depends on a due diligence that enables you to identify opportunities you can accelerate into action immediately after the deal closes – and working with the right due diligence consulting partner to make it happen.

1. Pivot to IT due diligence 2.0, and drive M&A value with technology

IT due diligence has always been an important part of the M&A due diligence process.

In the past, the benefits of technical diligence focused on uncovering red flags and avoiding unwanted surprises post-acquisition. Identifying the hidden costs, risks, and weaknesses in current systems and applications remains important, but forward-thinking PE professionals have found an improved approach to due diligence.

As Clément Mengue explains to Financier Worldwide, “Companies should assess current portfolio companies’ digital readiness and identify the required capabilities needed by each portfolio company to digitally transform and stay competitive over the long term. Typically, this results in the identification, quantification, and prioritization of various strategic and operational digital levers that could increase the EBITDA impact of a portfolio company’s business.”

TAKEAWAY:

Assessing a company’s digital readiness leads to identifying which strategic and operational digital levers can be pulled to increase EBITDA.

Given today’s opportunities to drive growth through digital business transformation, it’s time to shift your thinking to a value-driven approach across all technology segments and the investment lifecycle.

Consider the fact that digitally empowered employees report spending 17% less time spent on manual processes and making decisions 16% faster.

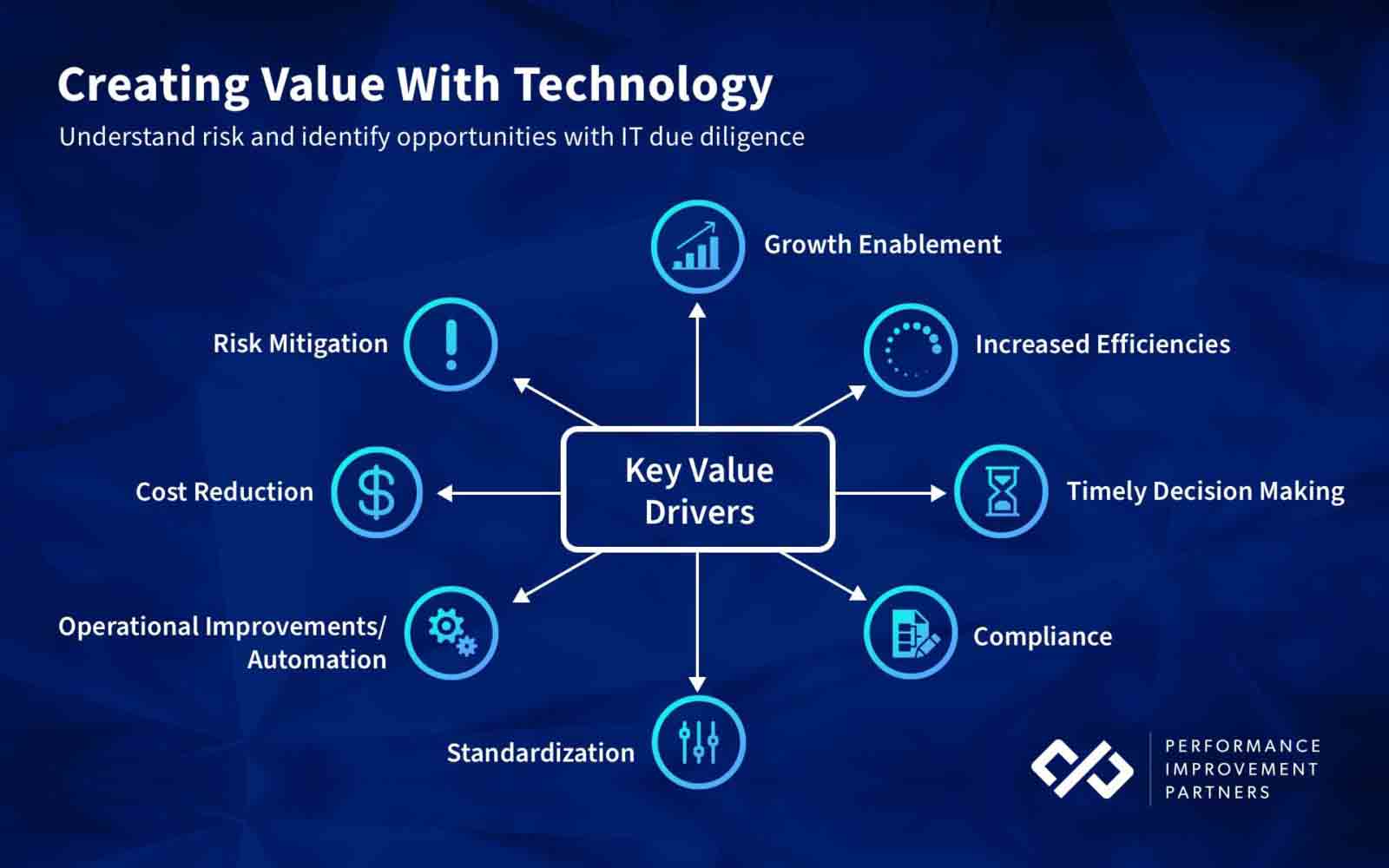

From enabling growth and timely decision-making through to reducing costs and mitigating risks, technology provides numerous ways to drive value post-acquisition.

By using the due diligence process to identify technology-driven value creation opportunities, PE firms can better understand investment potential, and which lever to pull to maximize growth.

Examples of these opportunities to drive value with technology include:

- Enabling business analytics and reporting – resulting in better, faster decisions based on real data

- Helping employees become more effective and efficient through modernized infrastructure and applications

- Improving the ability to forecast demand and meet customer needs

- Building automated efficiencies to create additional capacity for growth

- Deriving better customer insights for sales and improved product delivery with forecasting

- Enhancing employee collaboration through the use of digital tools

- Establishing improved relationships with customers and suppliers through better, more collaborative communication

Even areas such as cybersecurity, once examined purely from a risk-mitigation perspective, can be viewed through a value-driven lens: According to IBM’s 2020 Cost of a Data Breach Report, businesses with fully deployed security automation save an average of $3.85 million versus companies without one.

2. Use your technical diligence to move from insights to action post-acquisition

With IT due diligence serving as a core component of your value creation plan, the diligence report should enable you to move directly into your post-acquisition 100-day plan.

This means the diligence assessment needs to have recommendations that are both realistic and specific. If you’re given a list of 60 action items, which 15 are the most critical?

It’s also beneficial to work with a due diligence firm that understands both technology and the Private Equity deal lifecycle. You don’t want technology solutions that will take 20 years to pay back — pushing the ROI past your ownership lifecycle.

Transforming businesses is a core component of the M&A process, but it requires a phased approach to get from Point A to Point B. Your diligence report should pave the way, serving as the foundation for your IT roadmap, and guiding each step of the value creation plan with optimal efficiency.

Post-acquisition, the findings from your IT diligence assessment should enable you to:

- Identify actions to take immediately, such as hiring a new CTO

- Advise which short-term activities will generate results quickly, building momentum in your value creation plan

- Understand what is required to implement any larger technology initiatives, with a phased approach and approximate timelines for milestone moments

Working with a due diligence company that has the ability to not just advise, but also to execute on technology projects, accelerates your ability to rapidly implement changes post-acquisition.

The team already has an in-depth picture of the portfolio company’s IT capabilities, eliminating the time (and money) otherwise invested in onboarding a technology consulting firm.

3. Choose the right due diligence company for your M&A strategy

There are multiple types of M&A due diligence Private Equity firms must execute before investing. Some types – including financial and operational diligence – speak the language of PE professionals.

Technology due diligence consulting requires an entirely different skillset.

Not only do you need a team with real-world IT, software development, data, and technology experience, you need a due diligence firm that can summarize the results into a report you trust for your investment committee.

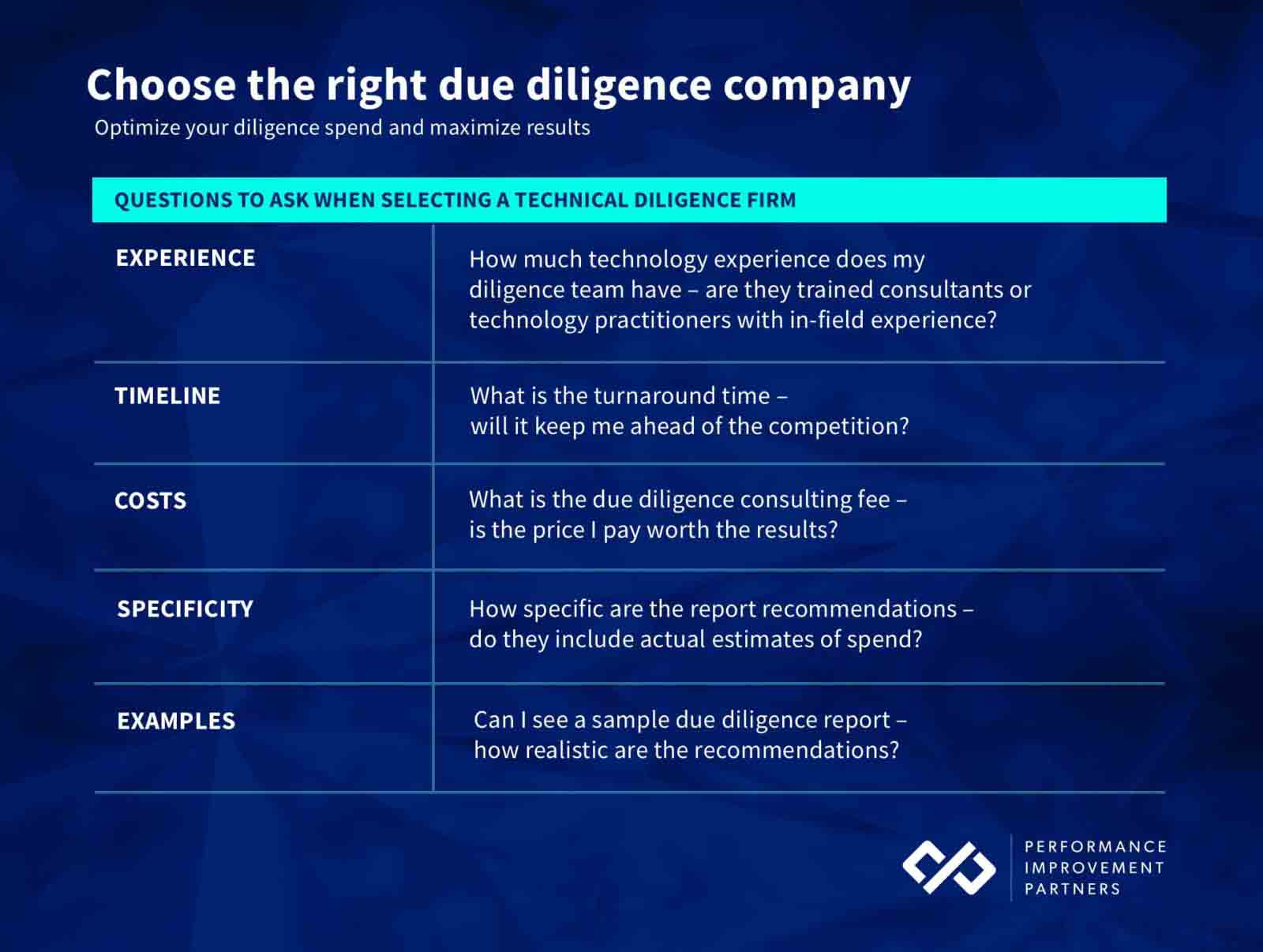

Finding the right M&A diligence company comes from asking the right questions.

Optimize your spend by asking potential diligence companies the following five questions:

1. What technology experience does the diligence team have?

When investigating an acquisition’s technology, you need a team with more than just book learning from a college degree: You want a proven team of technologists with in-field experience.

Find out: Is your diligence conducted by trained consultants or experienced technology practitioners?

Seasoned practitioners not only do 100’s of diligences each year, but they have also been technology leaders at organizations, giving them the ability to ask questions that drill deep into identifying potential problems and opportunities.

2. What is the turnaround time – does it move at the pace of Private Equity?

With technology fueling business efficiency, IT due diligence shouldn’t slow down deal activity. You need a diligence company that moves at the speed of Private Equity. Does your diligence firm need two weeks to build the project team, losing time and potential opportunities, or are they ready to jump in, meet deadlines, and help accelerate your M&A activity?

Need a diligence and need it now?

See how far your target company can scale: One minute is all it takes to get started.

[contact-form-7 id=”6169″ title=”Diligence Form”]

3. What is the due diligence consulting fee – is the price worth the results?

When deal activity is high, it’s easy to make vendor decisions based on the brand name alone. All too often, PE professionals turn to major accounting or consulting firms for their technical diligence without comparing due diligence documents and pricing. Are you paying for a brand name, or a report that drives results for your investment thesis? Building your Rolodex of technology diligence advisors will likely result in substantial savings.

4. How specific is the due diligence assessment?

Any technical diligence report will include an indication of recommended IT spend post-acquisition. But all-too-often, the only guidance provided is a few dollar symbols without numbers estimating the actual spend required. Find a diligence firm that will give you ballpark estimates to understand the true costs involved with the acquisition.

5. Can I see a sample due diligence report?

Talk is cheap. Don’t trust words alone when your investment thesis is on the line: Ask to see a due diligence report example, and make sure the results live up to the promises made during introductory sales calls. When examining a company’s diligence report, make sure the recommendations are realistic and align with your thesis and vision for the ownership lifecycle.

Next-level business transformation starts with IT due diligence

Long before the lockdown, Microsoft CEO Satya Nadella declared “Every company is a software company and a digital organization.”

Businesses today cannot function without technology. As such, deal teams find themselves living in a new age of Private Equity due diligence, where technology and financial assessments stand on equal ground.

You need a proven technology partner you can trust that will give you quality results at the price point you deserve.