Private Equity (PE) firms are facing unprecedented pressure: record dry powder, rising competition for quality assets, and sustained high valuations. In this environment, corporate carve-outs—acquiring divisions divested from large corporates—represent a compelling yet underutilized strategy for sourcing proprietary deals and unlocking rapid value creation.

Corporate carve-outs are increasingly becoming a strategic lever for Private Equity (PE) firms seeking rapid value creation. Yet, despite their potential, many firms hesitate to pursue carve-outs due to perceived complexity, execution risk, and integration challenges.

While many investors remain skeptical, viewing carve-outs as complex or operationally risky, firms that have developed repeatable carve-out capabilities are achieving superior returns and faster EBITDA growth compared to traditional buyouts. In reality, well-executed carve-outs deliver speed, clarity, and asymmetric value — allowing both buyers and sellers to unlock trapped potential, sharpen focus, and accelerate returns.

This paper explores why carve-outs deserve renewed attention from private equity investors, the common misconceptions holding firms back, and how to build a carve-out capability that consistently delivers results.

Carve-outs: The Untapped Growth Engine for Private Equity

In a dynamic M&A environment, speed to value is everything. Carve-outs convert corporate dis-synergies into PE upside.

Carve-outs offer access to quality assets at a discount, rapid value acceleration, proprietary deal flow, and enhanced exit readiness. These advantages align perfectly with PE’s mandate to buy complexity, transform it, and sell clarity. Unique Carve-out advantages:

- They often involve non-core but fundamentally sound business units, enabling faster operational turnaround.

- They allow PE firms to buy complexity at a discount — and monetize simplification through focus and operational rigor.

- They create immediate opportunities for governance, digital transformation, and cost optimization from day one.

Figure 1: Carve-Out Value Chain – From identification to exit.

Common Misconceptions

- “Carve-outs are too complex.”

With proper planning and Transition Service Agreements (TSAs), complexity can be structured, costed, and de-risked. - “Separation takes too long.”

Modern carve-out playbooks and cloud-based platforms enable Day-1 readiness and separation within weeks, not months. - “Value realization is slow.”

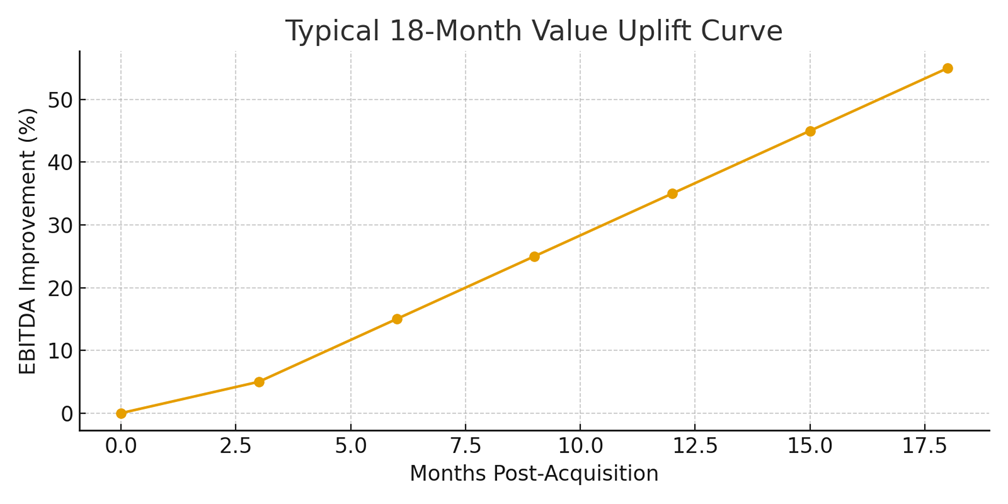

On the contrary — well-executed carve-outs can deliver EBITDA uplift within the first 12 months through focused operations, governance discipline, and capital efficiency.

Carve-out Myth vs. Realities | |

Myth | Reality |

Carve-outs are too complex | Modern Playbooks and SMOs streamline execution |

TSAs drag on for years | Time-Bound TSAs ensure smooth transition |

It takes years to stabilize operations | Standalone operations achievable in 6 – 9 months |

Figure 2: Carve-Out Myths vs. Realities – Common misconceptions and their practical truths

The Value Proposition

For Buyers – Carve-outs let you buy complexity low and sell simplicity high

- Acquire Focus: Carve-outs bring immediate operational clarity — no legacy distractions, no bloated corporate overhead.

- Buy Smart: Pricing often reflects the parent’s urgency to divest, not the asset’s intrinsic potential.

- Transform Fast: PE can drive transformation with agility — modernizing tech stacks, streamlining SG&A, and unlocking growth.

For Sellers – Strategic carve-outs turn portfolio noise into capital clarity

- Unlock Hidden Value: Divesting non-core assets improves focus and capital efficiency.

- De-risk Portfolio: Monetize assets before they drain management bandwidth.

- Accelerate Liquidity: Carve-outs drive faster closes and cleaner transactions versus full spin-offs.

For Buyers & Sellers – Carve-outs aren’t about complexity — they’re about clarity, speed, and value on both sides of the table

- Mutual Efficiency: Both sides benefit from focused scope, faster diligence, and lower integration overhead.

- Stronger Partnerships: Carve-outs foster collaboration — seller transparency meets buyer speed.

- Sustained Value: The transition playbook defines not just separation, but the future operating model.

Figure 3: Typical 18-Month Value Uplift Curve – Illustrating early-stage performance improvement

Accelerating Value Creation: The PIP Perspective – Carve-outs are no longer just transactions — they’re transformation catalysts.

At PIP, we’ve seen carve-outs deliver measurable value within the first 90 days post-close. Our structured methodology focuses on:

- Day-1 readiness – ensuring operational continuity and compliance.

- Target Operating Model design – reimagining the carved-out entity for agility.

- Technology separation and modernization – enabling cloud-native scalability.

- Synergy realization tracking – ensuring execution meets value assumptions.

Conclusion

Carve-outs, when executed with discipline, are a PE advantage, not a liability. They create the opportunity to acquire at value, transform with speed, and exit with returns.

The key is not to avoid complexity — but to own it through structure, planning, and execution excellence.