M&A transactions are inherently complex — but not all transactions carry the same level of risk, cost, or execution challenge. For Private Equity buyers, understanding the drivers of complexity early can mean the difference between accelerated value creation and costly surprises.

In this paper, we explore three critical perspectives:

- Complexity Dimensions – The common factors that can accelerate or derail value across any deal.

- How Complexity Differs by Deal Type – Why carve-outs, platform separations, and integrations each present a distinct profile of risks and costs.

- Implications for Private Equity – How sponsors can anticipate these challenges from diligence through Day 1 planning to protect returns and unlock full deal value.

By framing complexity through these lenses, investors can approach transactions with greater precision, discipline, and confidence — ensuring that deal execution aligns with the investment thesis.

Key Drivers of Complexity and Costs in M&A

When it comes to mergers, acquisitions, and carve-outs, not all transactions are created equal. The complexity — and the costs — vary depending on the type of deal and the specific dimensions at play. Private Equity buyers who anticipate these challenges early, from target screening through Day 1 planning, are better positioned to capture full transaction value.

Complexity Dimensions

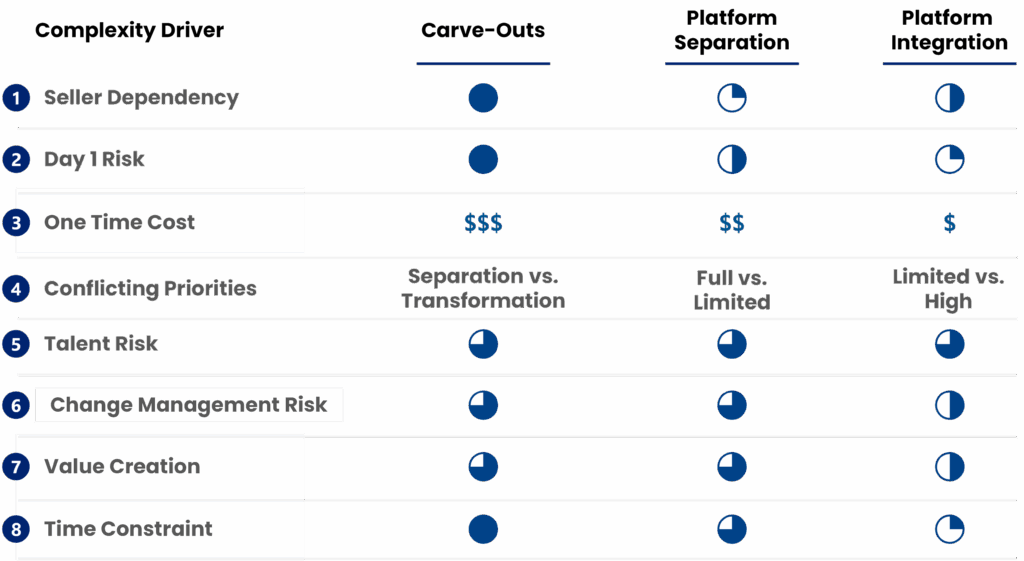

Across deal types, a common set of complexity drivers can either accelerate or derail value creation:

- Seller Dependency – Reliance on the parent for systems, processes, or talent.

- Day 1 Risk – The ability to operate independently at close.

- One-time Costs – Separation, stand-up, or integration expenses incurred upfront.

- Conflicting Priorities – Balancing separation activities with transformation initiatives.

- Talent Risk – Retaining and engaging critical people during disruption.

- Change Management Risk – The organization’s capacity to absorb and adapt to change.

- Value Creation – The ability to capture synergies, efficiencies, and growth opportunities.

- Time Constraints – Regulatory deadlines and market commitments that drive urgency.

Complexity Differs by Deal Type

Although the same drivers of complexity appear across most transactions, the way they manifest — and the risks they create — vary by deal type. Carve-outs, platform separations, and integrations each present a distinct profile of costs, dependencies, and execution challenges that investors must anticipate from the start.

Carve-outs

- High one-time costs (new systems, standalone functions).

- Significant seller dependency and Day 1 readiness risk.

- Tension between separation from the parent and building a future-ready platform.

Platform Separations

- Moderate costs depending on whether functions are transitioned fully or partially.

- Narrower but still material seller dependency.

- Time pressure, especially across multiple parallel workstreams.

Platform Integrations

- Lower Day 1 risk since operations continue, but complexity shifts to capturing synergies.

- Costs driven by process harmonization, systems integration, and talent alignment.

- Integration drag risk — slowing growth while teams adapt.

Recognizing these patterns early allows sponsors to plan with precision, control costs, and protect value across the deal lifecycle.

What This Means for Private Equity

Implications for Private Equity:

- Hidden costs: 5–10% of deal value lost if not modeled early

- TSA reliance: on average $500K–$2M per month in added costs

- Day 1 gaps: 2–5% revenue leakage in year one + compliance risks

- Cost Overruns: Carveouts (65%-70%), Integrations (50-55%)

- Schedule Overruns: Carveouts (75%), Integrations (65%)

- Missed Synergies: only 30 – 40% achieve planned synergies

Countermeasures for Investors:

- Hidden Costs: Factor complexity into valuation and model one-time costs early.

- TSA Reliance: Quantify TSA dependencies upfront; design early-exit strategies to cut costs.

- Day 1 Gaps: Prioritize operational readiness to ensure continuity and mitigate compliance/revenue risks.

- Cost Overruns: Apply disciplined planning and right-sized functional resourcing to stay within carve-out and integration budgets.

- Schedule Overruns: Balance speed and precision; use phased integration to reduce delays while protecting continuity.

- Missed Synergies: Model synergies early and embed change management to drive adoption and accelerate value capture.

Closing Statement

At PIP, we help Private Equity clients navigate the full spectrum of transaction complexity — from carve-outs to platform separations and integrations. Our proven playbooks, TSA modeling, and hands-on leadership ensure:

- Day 1 operational readiness

- Faster TSA exits and minimized stranded costs

- Optimized one-time costs aligned with investment theses

- Accelerated synergies and sustainable operating models

By anticipating complexity early and executing with discipline, sponsors can move with speed and confidence — positioning portfolio companies to achieve full transaction value.

The PIP Advantage:

- Day 1 ready: 100% continuity from close; avoid 2% – 5% revenue leakage

- Faster TSA exits: cut TSA duration by 30–50%; save $500K–$2M/month

- Right-sized costs: aligned tightly with the deal thesis

- Cost Control: eliminate 5–10% hidden costs, mitigate 55–65% overruns

- Execution: reduce 65–75% delays, achieve up to 95% on-time delivery

- Synergies : achieve more than 30–40%, 3–6 months faster